Search Results

Sorry, there are no matching results

Buying a car through your limited company

Limited company FAQs for contractors, business owners and entrepreneurs

If you're a contractor who, based on your unique circumstances, operate through your own limited company, you may be wondering what tax savings are available for using your own car for business purposes and what the implications of owning a car through your limited company may be. The considerations and implications of owning a car through the business are many, each option having various pros and cons. Considering all of these together can allow you to consider which is the most tax efficient option.

FAQs

When a company car is made available to a director or employee there are further tax considerations which need to be considered, these often make the difference in deciding which route is most tax efficient. The provision of a company car and payment of fuel by the company are taxable benefits in kind in the hands of the recipient, i.e. the director or employee. The value of the benefit ranges based on the type of vehicle, the CO2 emissions figure and the list price.

This benefit in kind value would be deemed as employment income, and would be taxed at 20% or 40% depending on if the individual is a basic rate or higher rate tax payer. The company would also be required to pay Class 1A National Insurance contributions on the benefit value at a rate of 13.8%.

In practice for limited company directors this normally means that purchasing or leasing a car through the company may not be the most tax efficient option, once the additional taxes payable are considered against the tax savings, it would often cost more to purchase the car through the company then personally. This is especially the case for cars which have a higher CO2 emissions figures.

If you use a personally owned vehicle for business purposes you are entitled to claim a tax free allowance from your company for all qualifying business miles you travel. A journey will be a qualifying business journey if it is wholly, exclusively and necessarily undertaken for the purpose of the trade.

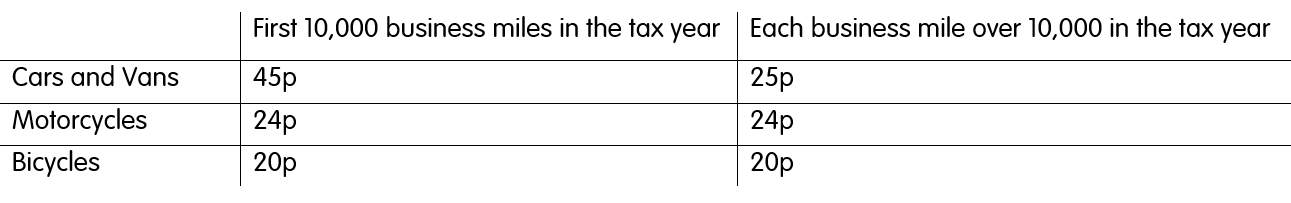

For these journeys relief can be claimed at the HMRC approved mileage rates which are as follows:

The cost of reimbursement of the business mileage will be a tax deductible expense for the company attracting corporation tax relief starting at 19%, reimbursement of the mileage will also be tax free when paid to you as the limited company director. If amounts are paid in excess of these rates although the company will still receive corporation tax relief of the full amount, the excess amount would be subject to personal tax and national insurance meaning for limited company directors it would not be tax efficient to pay any more than the approved rates.

These rates are designed to cover all vehicle related costs, such the actual cost of the car, insurance, servicing etc, therefore reimbursement of any other amounts in excess of the approved mileage rates would also cause tax implications.

Owning a vehicle through a limited company will make the car a company asset; the method of calculating a corporation tax deduction for this asset will depend on the type of purchase and the type of vehicle.

Firstly, like with the purchase of all assets, a deduction is not made for the full purchase price of the asset in the company accounts. Instead, tax relief is given through a capital allowance deduction when calculating the company corporation tax liability. The capital allowances available will depend on the CO2 emission levels of the vehicle.

Secondly, if the vehicle is not purchased outright and is instead purchased under a finance arrangement any interest paid under the agreement would qualify as a trading expense; the interest amount each year would qualify as a cost for the company when calculating profit and will therefore receive full corporation tax relief.

Instead of buying a vehicle, sometimes leasing may be a more viable option. In the case of leases the net monthly lease payment is a tax deductible expense and will therefore receive corporation tax relief, if the vehicle has a CO2 emission figure above 110g/km the tax deductible expense is capped at 85% of the lease cost.

If you choose to have a company car you will be subject to income tax based on a scale rate charge related to the CO2 emissions of the car you’ve chosen. If your company pays for fuel, there is a further charge. Your company will also pay Class 1A NICs on the benefits provided.

If you take a cash alternative to a company car you will be liable for NICs and income tax at your marginal rate on the full amount of the allowance as if it were salary.

Is it usually more tax efficient for you to buy a car personally and claim the HMRC mileage rate for all business mileage travelled.

Your company or your employer is required by the PAYE regulations to notify HMRC if you are provided with a company car. It is normally done online. If you wish you can also let HMRC know via your Personal Tax Account or calling their enquiry line with the details.

VAT can only be reclaimed on the purchase of a business vehicle where it is used solely for business purposes and is not used personally by the director or any employees. As most contractors, business owners and entrepreneurs would use the car personally as well as for business purposes reclaiming any VAT paid on purchase will not be possible.

In the case of leases for cars used personally as well as for business, 50% of the VAT amount can be reclaimed.

In the case of a vehicle owned by the limited company, all associated running costs would be tax deductible expenses. This includes, fuel if paid by the company, servicing, insurance and maintenance.

One specific cost to be mindful of is fuel, if the company is paying for fuel for the director this will normally also extend to fuel for personal journeys and will mean a fuel benefit in kind charge will apply to the director, this will incur further taxes for the director and a national insurance charge payable by the company.

If fuel is not paid by the company, the director or employee can continue to claim reimbursement for each business mile travelled, the rates at which the reimbursement can be paid tax free however will be lower.

If you use your own car for business purposes, as a director or an employee, you can claim the HMRC business mileage allowance which is deemed to cover all the costs of running a car (including fuel), at a certain rate per mile. The current rate is 45p for the first 10,000 business miles in a year and 25p per business mile thereafter.

Your company can also claim these mileage payments to you as a deduction from its profits. They are not taxable in your hands.

No, but you must record all the business mileage you incur so that your company or employer can justify making the mileage payments to you.

If you are claiming the HMRC mileage rate then no. If your company provides you with a company car together with the cost of fuel, you’ll pay tax on the benefit based on a scale charge linked to CO2 emissions.

In addition, if your company provides you with fuel there will inevitably be some used for private purposes. This means that your company will have to pay back VAT via a fuel scale charge for the private element.

The simple answer is that you can’t unless you can prove that literally no private mileage was ever driven. HMRC’s rules on benefits are very inflexible and unless the car qualifies as a ‘pool car’ and is used by several other employees, and subject to equally strict rules and conditions, it is very unlikely you can avoid the taxable benefit-in-kind.

Whether you're a contractor, business owner or entrepreneur for more tailored advice, speak to our accounts team.

Request a callbackRelated Pages

We use cookies to improve your experience on our site. To find out more review our privacy statement and cookie policy.