Search Results

Sorry, there are no matching results

Employment Intermediaries

What is the Employment Intermediaries reporting?

We can help with reporting required under the Onshore Employment Intermediaries legislation.

By way of background the legislation requires recruitment agencies to report to HMRC on all the workers they place on assignments. If on agency payroll this should already be done on a weekly basis (if paid weekly) through RTI reporting. If the agency pays the individual elsewhere (e.g. to an umbrella, a limited company or under CIS) then it must report the payment on a quarterly basis to HMRC.

When is the deadline?

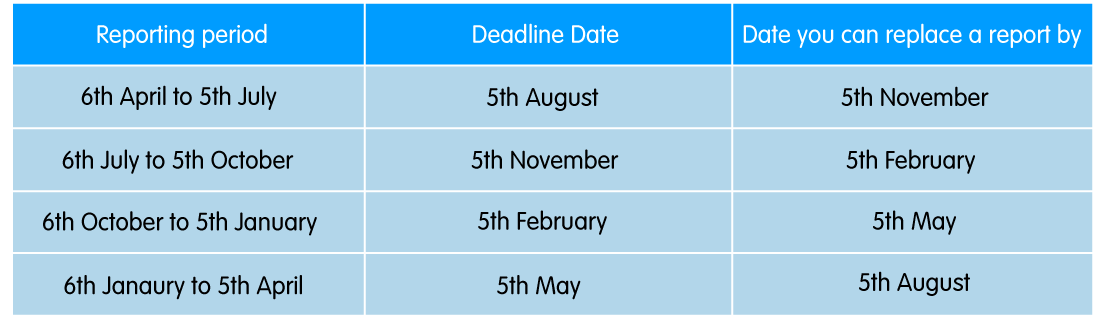

Here are the deadlines that you need to be aware of:

What information does HMRC require?

Employment Intermediaries details:

- name

- address

- UTR number e.g. PayStream My Max Limited, Mansion House WA14 4RW, UTR 1452527547

Worker details:

- name

- address

- DOB

- gender

- NI number

Worker engagement details:

- start and end date of assignment

- payment details (including VAT)

Most agencies will have this information except for maybe the NI number since they haven't paid the worker direct. Our contracts with the worker allow us to provide this information to agencies.

Introducing the agency portal

To keep things as simple as possible for the agencies we work with, PayStream have a portal which allows agencies to download all of the above information in CSV format, in the exact format that HMRC require it, ready for submission to HMRC. All it takes is the click of a mouse.

These reports are downloadable at any time and can then be checked against information held by the agency before being sent off to HMRC as part of the agencies quarterly report. Obviously if all workers are through PayStream there will be no need to amalgamate this report with others from other umbrella companies.

How can we help?

For further details on our Agency Portal and how it can help you with the Employment Intermediaries reporting, get in touch with our Agency Support Team on 0161 971 8979, or via email at agency_support@paystream.co.uk

We use cookies to improve your experience on our site. To find out more review our privacy statement and cookie policy.